Are you interested in our services?

Tim will be happy to answer any questions you might have.

ABS Secondary Market Grinds Tighter as Countries and Economies (Begin to) Reopen

ABS Secondary Market Grinds Tighter as Countries and Economies (Begin to) ReopenEuropean ABS Market Update

What a difference two weeks has made on the pandemic front. The epicenter of the COVID-19 crisis has shifted to Latin America and other developing countries. Case numbers continue to flatten in much of the developed world as countries continue to reopen their economies alongside plans to reopen some national borders in the form of “travel bubbles” and “air bridges”. To be clear, concerns about a second wave of infections in the second half of the year remain, especially in light of recent mass protests in the US and around the world. Nevertheless, the combination of a lack of reopening setbacks thus far and optimism that initial doses of a vaccine could be available by the end of the year have effectively alleviated a health crisis driven depression. This has been combined with effectively unlimited monetary policy support, putting a convincing floor under prices for equity markets and quality assets. Barring another unexpected event (e.g. a second wave of infections, a spiraling trade conflict between the US and China, or simply a monetary or fiscal policy mistake of withdrawing support too early), we have likely already seen the bottom for high grade assets. Still, it remains clear that the global economy is at risk of a more garden variety downturn lead by persistent high unemployment, wage declines, and some likely permanent changes in consumer spending behavior, all of which indicate a likely slow and uncertain recovery process which will result in significant stress on overleveraged companies and other credit sensitive assets which don’t benefit from direct monetary policy support.

While continued monetary policy support is largely expected, such as the recent expansion in size and duration of the ECB Pandemic Emergency Purchase Program, broader fiscal support has largely been tabled as the initial urgency from early stages of the crisis has subsided. In the US, little progress on an additional stimulus package following March’s $2 trillion CARES Act has been made. At the same time, the European Commission has unveiled a plan for a EUR 750 billion recovery fund based on an initial initiative by France and Germany, but the road to its implementation remains uncertain due to opposition by some members of the EU. However, there remains a convincing case for additional fiscal support, due to historic worldwide unemployment. Although unemployment levels in the Eurozone has been significantly lower (7.3% in April) than the estimated 20% level in the US due to wage subsidy programs, estimates of over 40 million on furlough schemes highlight similar levels of potential stress in the European labor force.

In ABS markets, primary market flow continues to be very slow. Aegon recently closed a fully retained Dutch prime RMBS while the German auto loan ABS sold by Mercedes Bank at the end of May highlighted weak end-investor demand as almost 75% of bonds were placed with banks and central banks.

At the same time, secondary markets have continued to grind tighter on light volume. However, we are beginning to see increased selling appetite in more credit sensitive “story bonds” as the market continues its upward trend. Additionally, we have seen an uptick in activity in asset classes such as in European CMBS, where trading had previously ground to a halt following the outbreak. While we remain wary towards CMBS exposure, it does offer pockets of value for investors with a positive outlook. A renewed rally in European high yield credit also extended to the CLO space, despite worsening fundamental performance. Issuance in CLOs remains negligible with only four deals done in May, marked by lower leverage, small deal sizes, and large amounts of preplacement.

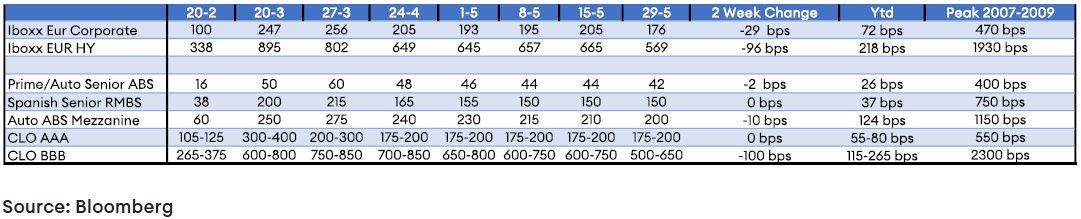

Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of May 29, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.