Are you interested in our services?

Tim will be happy to answer any questions you might have.

A Breath of Fresh Air for ABS

A Breath of Fresh Air for ABSIn a financial system dominated by banks, securitization has helped unlock significant amounts of capital and improved lending conditions for consumers and small businesses. In 2015, the European Commission estimated these amounts between EUR 100 and 150 billion if bond issuance in EU securitization could return to pre-crisis levels[1]. Mindful of the excesses of the last financial crisis, however, there have been significant efforts to ensure that the growth of lending is responsible and sustainable.

While the use of opaque ABS structures has already retreated, the European Commission is giving securitization a fresh push through the new comprehensive Securitization Regulation (“SR”), effective per 1 January 2019. This set includes the Simple, Transparent and Standardized (“STS”) securitization framework. It clarifies due diligence obligations between ABS originators, underwriters, and investors and brings existing rules on EU securitizations (for example in Solvency II, AIFMD and CRR) under a common roof. While compliance with STS framework is not compulsory, both issuers and investors clearly have an incentive to structure and invest in STS-compliant securitizations, as we will describe later.

<blockquote><p>The European Commission is giving securitization a fresh push through the new comprehensive Securitization Regulation (“SR”), effective per 1 January 2019</p></blockquote>

The STS framework can be divided into three parts. Below the most important criteria of each part:

The compliance with the STS requirements must be verified by an independent Third Party Verification Agent, authorized by the local financial authorities. That agent must ensure that issuers treat investors fairly and ensure that loans are placed into securitizations are of the same quality as those held on their own balance sheet (i.e. no adverse selection[2]). These requirements will likely increase both collateral quality and loan data quality for ABS investors, which will reduce credit risk and increase quality of investor analysis. While STS will also result in higher costs for issuers and not all ABS that our Fund invests in (such as CLOs and CMBS) will yet qualify for STS treatment, we are hopeful that this is the first step to more sustainable and responsible growth of the ABS market.

When the Solvency II Directive came into effect, capital requirements against investments in ABS soared, especially compared to other fixed-income asset classes and whole loan exposures. This resulted in the virtually complete retreat of the European insurers from the European securitization market[3]. As a result, banks and asset managers currently constitute a clear majority of investors in European ABS.

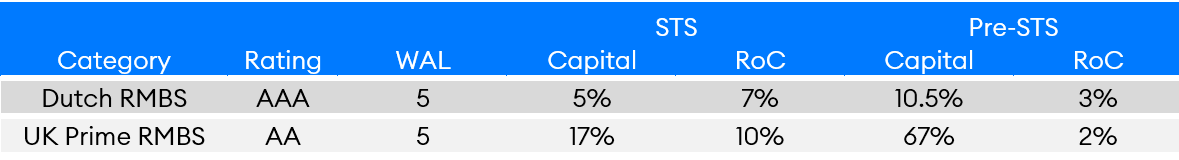

Under the new STS regime, the Solvency II capital requirement across the rating spectrum is lowered for STS compliant deals which will make investing in ABS more attractive and bring the treatment of securitizations more in line with other risk assets, such as covered bonds. This will strongly incentivize STS-compliant issuance, which will require insurance investors to hold significantly less capital coverage compared to non-STS compliant deals. The less capital the insurance companies need to hold for an investment, the higher the return on capital. In the table below, we display the improvement for two different types of securitizations. By bringing back a large portion of the pre-crisis ABS buyer base, this is a significant step towards attracting more originators and the issuance of more diverse types of ABS, but more importantly, it enables more funding for consumers and SMEs which drive the real economy.

Source: JPM Research (2019), European Commission (2018)

Source: JPM Research (2019), European Commission (2018)

The introduction of the STS label by the European Commission, and improved capital treatment for banks and insurance companies should lead to a healthier, more efficient, and bigger securitization market and more investment in attractive alternative investments which fund the real economy. We enthusiastically endorse any developments that support our mission to better match savings and credit for a more prosperous society.

[1] http://europa.eu/rapid/press-release_MEMO-15-5733_en.htm?locale=en

[2] Guidelines on the STS criteria for non-ABCP securitization, EBA, 12 December 2018

[3] Opinion of the European Central Bank from 11 March 2016, ECB

The information contained in this article (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Dynamic Credit and its associated companies to be reliable, but are not guaranteed as to its accuracy or completeness. Such information is provided without obligation and on the understanding that any person who acts upon it or changes his investment position in reliance on it does so entirely at his own risk. The information contained herein is suited for professional investors only and does not constitute an offer to buy or sell or an invitation to make an offer to buy or sell shares in any investment referred to herein. Information in this article is current only as at the date it is first published and may no longer be true or complete when viewed by you. All information contained herein may be changed or amended without prior notice although neither Dynamic Credit and nor any of its associated companies undertakes to update this site regularly. Past performance may not be a reliable guide to future performance.

NOTHING CONTAINED IN THIS ARTICLE CONSTITUTES INVESTMENT, LEGAL, TAX, OR OTHER ADVICE OR RECOMMENDATION, NOR IS TO BE RELIED ON IN MAKING AN INVESTMENT OR OTHER DECISION. YOU SHOULD OBTAIN RELEVANT AND SPECIFIC PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT DECISION.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.