Are you interested in our services?

Tim will be happy to answer any questions you might have.

ABS Spreads Trading Tighter in Spite of Deterioration in Borrower Credit Situations

ABS Spreads Trading Tighter in Spite of Deterioration in Borrower Credit SituationsEuropean ABS Market Update

It’s a bit hard to believe, but we are now more than three months into the COVID-19 crisis. While unprecedented government response has created some stability in financial markets, significant uncertainty around the path to the economic recovery continues to preoccupy investors. At the same time, worldwide COVID-19 infections continue to grow and are now approching the 11 million mark as daily new case reports come in at record levels. As lockdowns across Europe are easing, secondary outbreaks are beginning to flare up and cases are (re) surging in the Americas and parts of Asia. Although monetary policy has provided a floor for asset prices, we are likely close to the limits of a financial asset recovery without a corresponding recovery in the real economy, which will likely take years. This manifested itself in the last two weeks as worldwide equity markets moved lower as new infections and economic uncertainty continued to rise. In fixed income markets, monetary policy has radically changed the market as the ECB expected to buy EUR ~€10 billion/month of corporate bonds until at least June 2021, which could take their total holdings up to ~35% of the eligible universe. On the high yield side, while there has been credit deterioration – significantly so in some sectors – there have been few defaults so far which has continued to drive spreads tighter. IG and HY spreads are now relatively tight at only 52 bps and 192 basis points, respectively, wider year to date.

European ABS issuance rose to EUR 20.9 billion in 2020 YTD, 20% below 2019 YTD. European ABS secondary spreads remained steady to slightly tighter over the last two weeks, as BWIC activity in remained healthy and trade execution remained robust. This technical strength persisted in spite of obvious signs of distress, not in terms of delinquency rates, but reflected by increases in loan forberance and payment holidays. While there is considerable divergence across jurisdictions and asset classes, there is also significant variation of borrower forbearance programs within asset classes which creates opportunities. On one end of the spectrum Dutch RMBS continue to perform well as utilization of programs has remained low in the Netherlands. At the opposite extreme, UK RMBS has seen prices fall as borrower utilization of programs has become widespread due to loose certification requirements, with one deal showing over 50% of borrowers not making full payments.

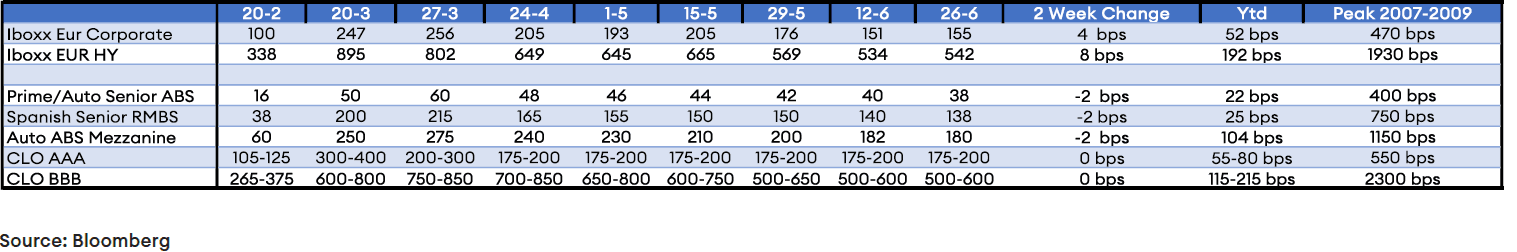

Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of June 26th, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.