Are you interested in our services?

Tim will be happy to answer any questions you might have.

ABS Trading in Stable Range, CLOs Weaken on back of Rating Agency Downgrades…

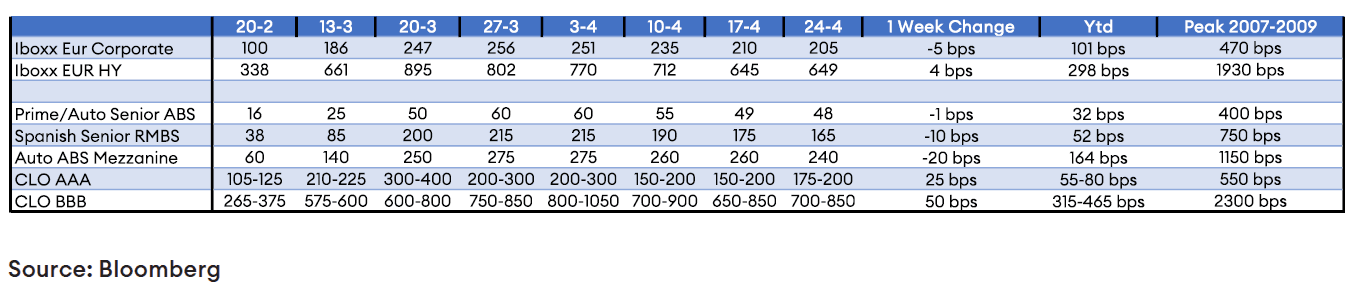

ABS Trading in Stable Range, CLOs Weaken on back of Rating Agency Downgrades…<p><a href="//assets.ctfassets.net/wfy6dr2scndo/16gmGGSct82PsotJv3ScUy/3f213aff95aa2b343634acef9ae0b079/Euro_ABS_Commentary_01.05.2020.pdf">Download as PDF</a></p> <p><strong>European ABS Market Update</strong></p> <p>Global equity markets continued the recent upward trend amid optimism that the economy in some parts of Europe and the US were beginning to reopen. We continue to cheer news of flattening of COVID-19 curves coupled with hopeful announcements coming from pharmaceutical companies developing potential treatments. Unfortunately, a vaccine allowing for a return to “normal” likely remains at least 12 months away. As shown in Japan, Singapore, and now Germany, premature easing of lockdown restrictions can result in secondary infection clusters and transmission rates reversing the downward trend. On a more positive note, New Zealand announced that COVID-19 has been “eliminated” in the country and moved to ease into a less restrictive lockdown. Energy continues to experience elevated volatility as optimism over reopening conflicts with dwindling storage capacity, with June WTI settling in the low double digits and international benchmark Brent around $20.</p> <p>In terms of fundamental credit performance, we continue to see credit rating agencies reacting significantly faster this time around compared to the financial crisis as they downgrade ABS transaction citing worse than expected performance or reflecting counterparty exposure following servicer downgrades. Having received a number of post-March investor reports from a wide cross-section of country and asset types, we see an increase in arrears. Risker deal types, including non-performing loan and subprime auto transactions, are likely to experience more material deterioration in credit performance which can result in impairments to mezzanine positions. In CLO markets, over 1,000 mezzanine CLO tranches have been placed on watch for ratings downgrade by multiple rating agencies, which contributed to more negative sentiment relative to other asset classes.</p> <p>While equity markets rallied last week, most ABS traded in a stable range with senior and shorter duration bonds trading better and more credit sensitive and longer duration positions were flat to wider on low trading volumes. The ABS primary market is still technically on hold with only one VW Bank auto deal closed via private placement. In the CLO primary market, banks are trying to sell existing warehouse exposures from their balance sheet. The first CLO deals were placed since the beginning of the COVID-19 outbreak, including some without non-investment grade tranches. In the secondary market, CLOs weakened after rallying the previous two weeks as the market digests the elevated risks of loan defaults and rating downgrades amid heavier selling volume. Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of April 24, 2020:</p> <p><img src="//images.ctfassets.net/wfy6dr2scndo/7wJcwMyefMKzhkW4fGrVxp/9c52c83085d42658f310ef41c337a0e8/abs-trading-stable-range-clos-weaken-rating-agency-downgrades_table1.png" alt="abs-trading-stable-range-clos-weaken-rating-agency-downgrades table1" /></p> <p><em>Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.</em></p>

Tim will be happy to answer any questions you might have.