Are you interested in our services?

Tim will be happy to answer any questions you might have.

Amid Recessionary Economic Indicators, Bond and Fixed Income Markets Tell a Different Story

Amid Recessionary Economic Indicators, Bond and Fixed Income Markets Tell a Different StoryEuropean ABS Market Update

COVID-19 case numbers continue to flatten in much of the developed world, in line with expectations. A sense of urgency from unprecedented unemployment rates has kept attention on governments to provide a path towards easing quarantine measures and reopening their respective economies. Since the start of quarantine measures in mid-March, 33.3 million Americans have filed for unemployment benefits, with some predictions that the unemployment rate could rise to Great Depression levels of 25%. In contrast, Europe is generally expected to see relatively mild, mid-single digit increases in unemployment due to government wage replacement programs. However, Q2 GDP estimates across the board are expected to highlight a severe recession. Despite this negative picture, equity markets continued their upward trend last week on continued monetary and fiscal stimulus combined with optimism that the economy will reopen and begin to recover in the second half of this and the first half of next year.

Bond markets are telling a somewhat different story with plunging rates and expectations that US rates could go negative in 2021. However, the tone in fixed income markets more broadly was also constructive with spreads in both investment grade and high yield corporates tighter month-over-month (although the recovery has stalled somewhat since mid-April as the market remains at a crossroads). In ABS markets, the recovery was more muted given the embedded structural leverage in mezzanine positions. The technical imbalance between supply and demand from low trading volumes has still resulted spreads grinding tighter in April, but the market is bifurcated as senior and short duration bonds trade very well, while credit sensitive and longer duration bonds remain scarce. On the primary side, we continue to see limited activity with two securitizations being priced recently. Both a German SME collateralized and an Irish mortgage backed deal were retained. The new issuance pipeline consists of one German auto loan securitization, coming from BMW Bank, with only the senior tranche on offer. In the CLO new issue market, only one deal priced last week, bringing the post-virus issuance count to four, three of which were arranged by Citi.

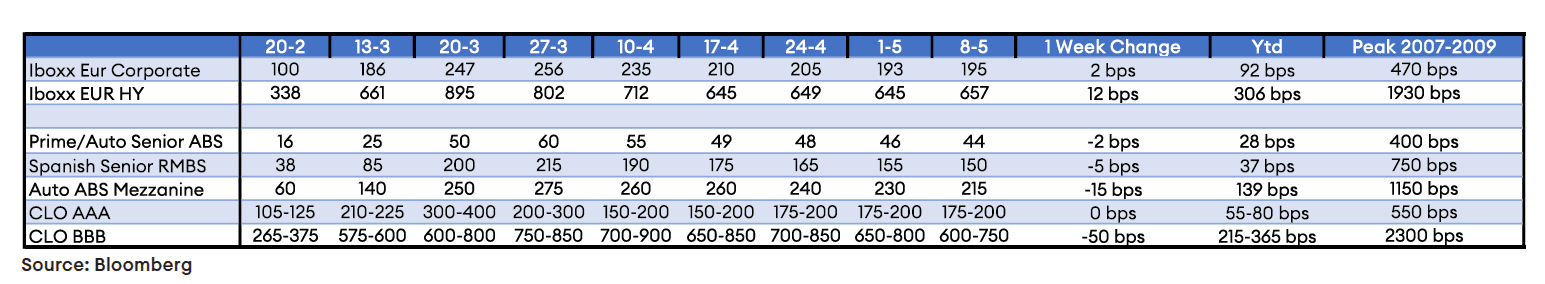

Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of May 8, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.