Beware Investments Bearing False Liquidity

Beware Investments Bearing False LiquidityBlog

Beware Investments Bearing False Liquidity

ETFs are popular because they are usually traded in real-time and offer daily liquidity. In case of illiquid assets, such as corporate loans, this may be true in benign trading environments. However, it is highly uncertain that liquidity will be there when it is needed most.

Senior loan ETFs are a relatively recent development on the back of wildly successful equity ETFs. They are designed to passively track a loan index and offer investors both the secondary liquidity of the ETF shares and primary liquidity via redemption request to the fund manager. Selling ETF shares is a suitable solution in many cases and the product often works exactly as designed, providing easy tradability as compared to portfolios of loans. However, does the same hold in periods of high selling pressure when investors are likely to need liquidity the most? Like equity ETFs, it is not uncommon for the share price of loan ETFs to deviate from its underlying net asset value ("NAV") during periods of volatility. In these cases, one of the benefits of the ETF structure is its ability to sell its underlying assets to facilitate a direct share redemption; this is quite attractive provided the assets can be sold quickly at the NAV. While this works well for equities, the reality is often different for loans where settlement can take up to a month.

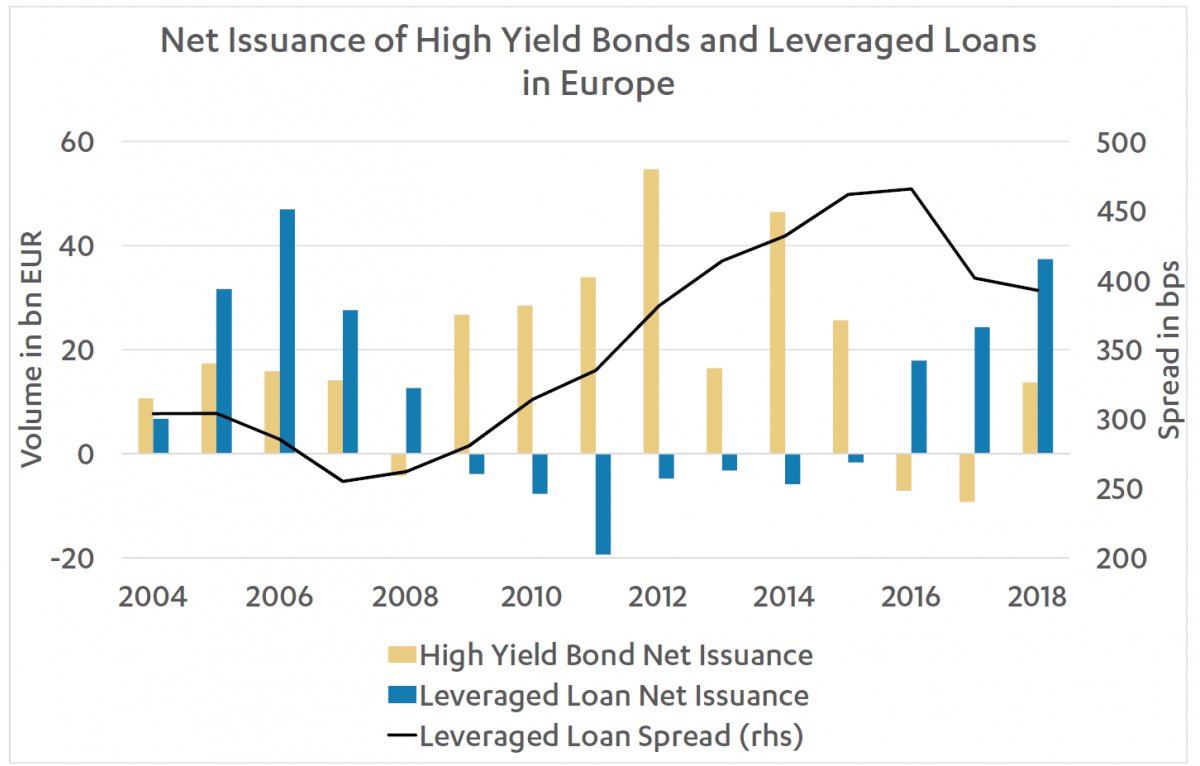

| One natural result of the increase in demand for CLO debt is the higher availability of funding to companies, backed by Private Equity or otherwise, which have generally taken out increasing amounts of inexpensive debt. In fact, 2018 was the best year of issuance for CLOs post-crisis in Europe and the highest ever in the US. However, the other side of increasing volume is the decline in loan quality, as companies have an ever-growing debt load in the face of a rising rate environment. So far, the effects have been relatively minor because many borrowers have taken the opportunity to delay the maturities of their debt. Nevertheless, investors should be cautious as those borrowers will eventually have to refinance at higher rates in the future. Chart 1 shows how the issuance of leveraged loans as well as their spreads have developed in Europe. |  Source: Morgan Stanley, December 2018 Source: Morgan Stanley, December 2018 |

<blockquote><p>When an ETF manager needs to sell a basket of loans into the market, it exposes the ETF and its investors to the same liquidity issues as a direct loan holder.</p><span class="writer">Mike Li</span></blockquote>

The central point

Herein lies the central point: while the investment vehicle for the underlying risk exposure can often improve liquidity at the margins, it cannot fundamentally create demand that isn’t there. When an ETF manager needs to sell a basket of loans into the market, it exposes the ETF and its investors to the same liquidity issues as a direct loan holder. Even in typical periods, some loans can be hard to trade and selling in large volume can require selling at a discount, and even more so during periods of market turmoil. For example, the senior loan ETF "BKLN" saw an outflow amounting to more than 10% of assets from November 13 to November 22. The shares of the fund traded down about 1.6% over that time frame. In comparison, the S&P/LSTA U.S. Leveraged Loan Index, which is the underlying benchmark, was down by 0.7% over the same period despite the fund having a tracking strategy [1].

A related benefit of buying into a large ETF (or any other active or passive fund) is the ability for smaller investors to gain exposure to a large diversified portfolio with lower trading costs and less operational hassle. This concept works well with equity ETFs, where high underlying liquidity allows for continuous rebalancing and thus a smaller tracking error to the benchmark. The difficulty for loan funds is that illiquidity in secondary markets naturally results in higher tracking error for passive funds.

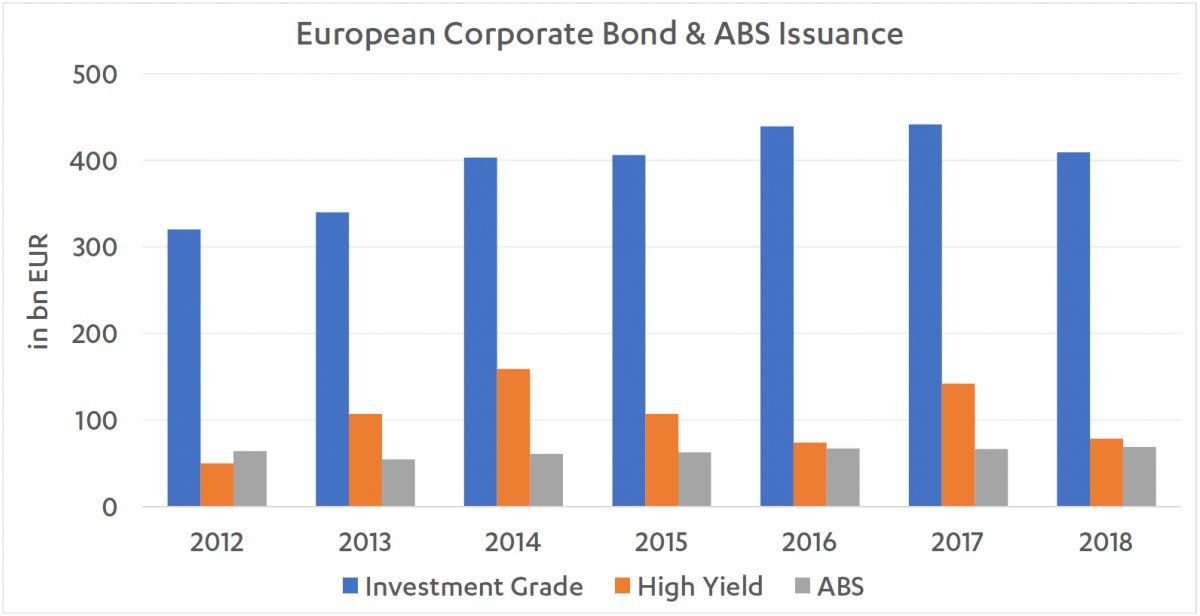

A parallel can be drawn to asset-backed securities ("ABS"), which are also less liquid than stocks or government bonds although operationally easier to trade than loans. While we are not aware of a passive European ABS ETF, illiquidity also affects investors in active strategies in important, albeit different, ways. One key issue in ABS markets is that new issuance is easier to source than securities in the secondary market, where bonds appear infrequently and typically in small sizes. This creates a natural pressure in portfolio composition to skew towards newer and larger issues, especially for larger funds that need to remain fully invested. The pressure to "buy the new issue market" creates less room for active investment selection, especially because net supply in European ABS has only recently started to grow and remains only a fraction of the corporate bond market, as highlighted in Chart 1.

Source: J.P. Morgan, December 2018

Source: J.P. Morgan, December 2018

Authors

Mike Li

Senior Portfolio Manager

+1 212 710 6608

Mike Li is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities and Direct Lending and heads the New York office. Mike joined Dynamic Credit in 2007 and was part of the team that set up the Amsterdam office in 2009, before moving back to New York in 2012. He has been investing in a broad spectrum of cash and derivative credit products in the US and Europe for over 10 years. Mike began his career at Deutsche Bank in the Graduate Programme, rotating through several business lines, including Agency MBS Trading and CDO Trading/Warehousing. Mike holds a M.S. in International Finance from the University of Amsterdam and a B.S. in Finance and Accounting from New York University.

Tim Jansen

Senior Portfolio Manager

+31 20 705 95 94

Tim Jansen is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities. Tim joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in his role as Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a M.S. in Econometrics from Erasmus University Rotterdam.

Pascal Buehrig

Junior Analyst

Pascal Buehrig is a former Junior Analyst at Dynamic Credit.

Sources

[1] Bloomberg (11/23/2018). Senior Loan ETF Sees Massive Outflows as Credit Cracks Deepen.

For further information, please contact:

Tim Jansen

T: + 31 20 794 9594 E: tjansen@dynamiccredit.com

For a more elaborate update on the performance of the Fund the Annual Performance Review 2018 on the website of Dynamic Credit (www.dynamiccredit.com). If you would like to receive our monthly Fund update in your mailbox, please send an email to sales@dynamiccredit.com.

Disclaimer

The information contained in this document (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Dynamic Credit and its associated companies to be reliable but are not guaranteed as to its accuracy or completeness. Such information is provided without obligation and on the understanding that any person who acts upon it or changes his investment position in reliance on it does so entirely at his own risk. The information contained herein is suited for professional investors only and does not constitute an offer to buy or sell or an invitation to make an offer to buy or sell shares in any investment referred to herein. Information in this document is current only as at the date it is first published and may no longer be true or complete when viewed by you. All information contained herein may be changed or amended without prior notice although neither Dynamic Credit and nor any of its associated companies undertakes to update this site regularly.

NOTHING CONTAINED IN THIS DOCUMENT CONSTITUTES INVESTMENT, LEGAL, TAX, OR OTHER ADVICE OR RECOMMENDATION, NOR IS TO BE RELIED ON IN MAKING AN INVESTMENT OR OTHER DECISION. YOU SHOULD OBTAIN RELEVANT AND SPECIFIC PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT DECISION.