Are you interested in our services?

Tim will be happy to answer any questions you might have.

COVID curves may be flattening, but markets are at a crossroads

COVID curves may be flattening, but markets are at a crossroadsEuropean ABS Market Update

Markets remained volatile last week, with soft economic data driving a decline in equity markets. On a more positive note, data on the coronavirus published over the weekend included some green shoots in the form of indications that curves may be flattening in some countries. The numbers of new confirmed cases, deaths, and people needing to be hospitalized are coming down in several countries, providing signs that extreme policy measures taken to contain the virus are bearing fruit. While this is hopeful news, in our view, the ‘COVID-19 crisis’ will consist of three distinct phases:

We optimistically see most of continental Europe in the shutdown’ phase of the crisis, while other regions, most notably the US and UK, are still likely several weeks behind.

In previous updates, we noted that in order to call a bottom, the market would need to see both a peak in new cases as well as signs that the post-pandemic economy remains relatively intact. While we do not take the underlying health crisis lightly, the resulting economic damage from policy measures taken in response may be just as damaging. In our view, the recovery path will be a slow and unpredictable one. As quarantine measures are slowly lifted, impediments to normal economic activities will likely continue for at least 12-18 months until a vaccine has been developed. With governments wary of re-importing new cases, international air travel volumes are not likely be revived any time soon. Furthermore, post-epidemic consumer behavior may be slow to normalize considering the enormous shock to public, private, and household balance sheets. Service sectors such as tourism, leisure, and gastronomy will likely be the last to recover. In our view, this process will take time and there will likely be aftershocks once the initial impact of the virus has been mitigated.

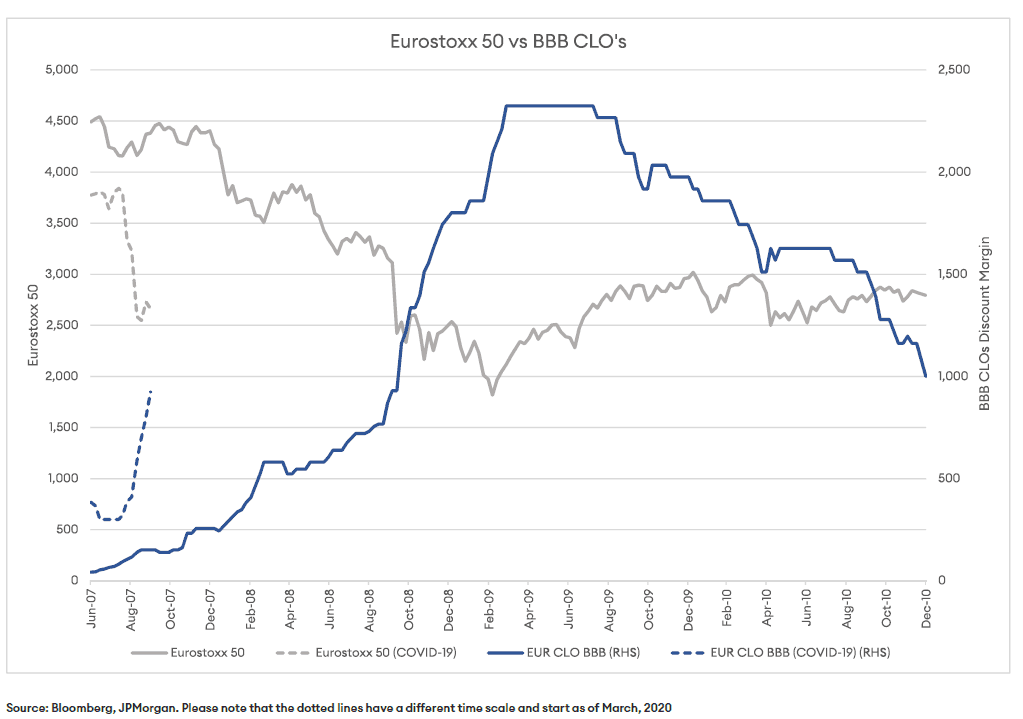

It remains up for debate whether equity markets have bottomed, as we see valid arguments from both sides. However, even if equities have turned the corner, in our experience credit both lags equities in materialization of downside risk and takes significantly longer to recover to pre-crisis levels (see chart below). Comparing the Euro Stoxx 50 and BBB CLO spreads during the financial crisis, we note that although equity markets clearly bottomed in March 2009, they had already come close by September 2008, with limited downside from that point. In contrast, BBB CLOs saw credit spreads triple from already elevated levels over the same period, with no clear reversal until the second half of 2009. In fact, we did not observe a normalization of credit spreads for years(!) afterward (although this was compounded by the Eurozone crisis). While it remains early days, the chart below highlights the unprecedented speed at which this crisis has unfolded. Credit is already showing signs of continued deterioration, even as equities show signs of stabilization.

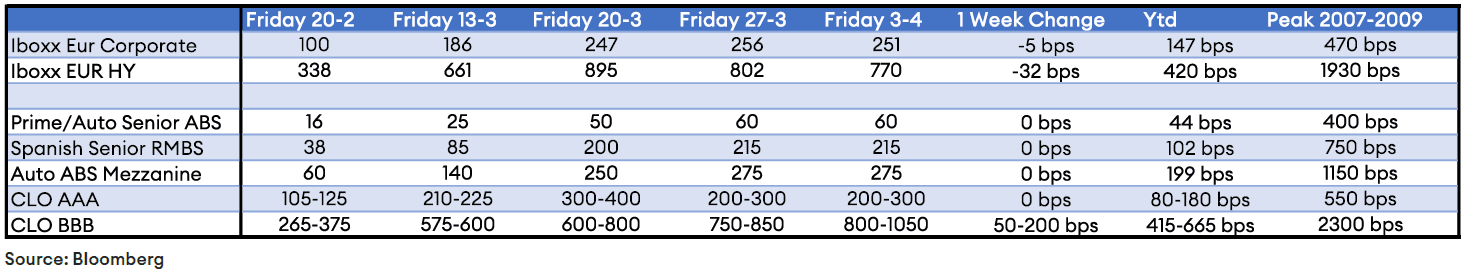

This week in the credit space we saw most asset classes trading stable to slightly better compared to last week. The exception being mezzanine CLOs, which traded wider again. BWIC execution held to this pattern, with AAA CLOs trading well (80% execution rate) while mezzanine CLOs traded less frequently (40% execution rate) as buyers and sellers were further apart. Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of April 3, 2020. We also added the year-to-date spread movement as well as the peak level reached in the financial crisis period of 2007-2009:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.