Would you like to receive our quarterly Housing Market update in your mailbox?

Then sign up below! If you have any questions, please do not hesitate to reach out to Jasper and his team.

Dynamic Credit Dutch Mortgage Market Update Q3

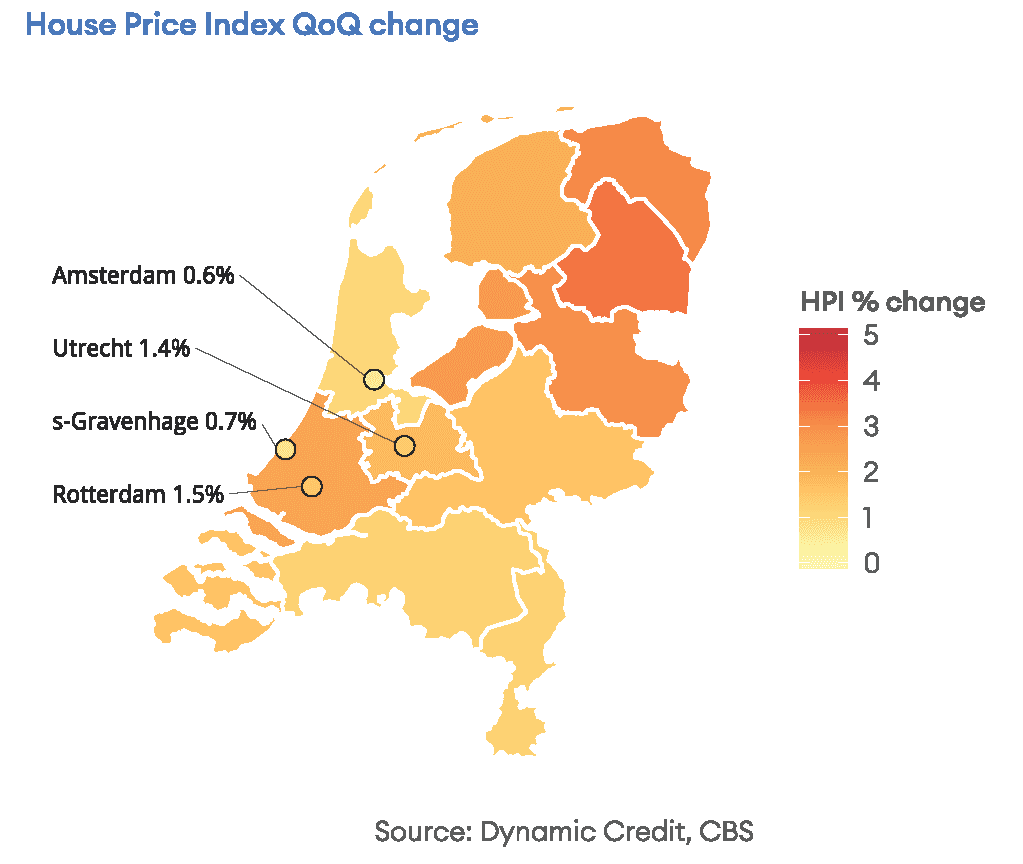

Dynamic Credit Dutch Mortgage Market Update Q3<p><strong>Spread levels normalizing, home prices increasing at a slower rate, and will mortgage rates in the Netherlands go negative as they did in Denmark? Find out now in our Q3 Dutch Mortgage Market Update.</strong></p> <p><em>Download the full <a href="http://bit.ly/2Cbl0gM">Dynamic Credit Dutch Mortgage Market Update Q3 2019</a> here.</em></p> <h4>Spread levels normalized</h4> <p>In the previous quarter, mortgage spreads reached levels that were higher than previously seen in 2018 and 2019 as mortgage rates were slow to respond to decreases in swap rates. That trend continued at the beginning of 2019-Q3 but a significant reaction came in August and September as mortgage rates in the Netherlands decreased by 37 basis points on average across major fixed rate periods and risk classes during the quarter. Rate decreases continued in October but slowed down towards the end of the month.</p> <p><img src="//images.ctfassets.net/wfy6dr2scndo/1zNEHg1QVbjgSALVlifsqG/57e02d9604e1eb382b39bd7aee6d9f07/dynamic-credit-dutch-mortgage-market-report-q3-2019_table1.png" alt="dynamic-credit-dutch-mortgage-market-report-q3-2019 table1" /></p> <h4>House prices are still increasing but the pace is slowing down</h4> <p>Increases of 1.8% during 2019-Q3 were higher than in the previous quarter (1.1%). Prices in the 4 main Randstad municipalities all had lower QoQ growth than the national average, highlighted by Amsterdam where prices only increased 0.6% QoQ. Drenthe (+3.4% QoQ) and Groningen province (+3.1%) increased the fastest. Prices in Noord-Holland only increased 1.1% QoQ.</p> <h4>Negative mortgage rates in Denmark are not comparable to Dutch rates</h4> <p>Lately there has been increased attention from Dutch news outlets on Danish mortgage rates. The reason was a Danish Bank launching a mortgage with a negative coupon rate during the quarter which triggered the question if Dutch rates would also get into negative territory. We have investigated the differences between Dutch and Danish mortgages.</p> <p><em>Spoiler alert: Danish rates are not comparable to Dutch rates and negative rates are very unlikely in the Netherlands.</em></p> <blockquote><p>”The summer ended with steep decreases in mortgage rates, as a delayed response to decreasing swap rates, resulted in spread levels normalizing. We expect the NHG market share to sharply increase in 2020-Q1, reflecting the upcoming increase in NHG limit from EUR 290K to EUR 310K.”</p><span class="writer">Jasper Koops</span></blockquote> <p><em>If you would like to receive our housing and mortgage market update in your mailbox on a quarterly basis, please send an email to dutchmortgageteam@dynamiccredit.com.</em></p> <p><strong>Disclaimer</strong> Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsondernemingsvergunning) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten). This presentation is intended for informational purposes only and is subject to change without any notice.The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security or financial instrument. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this presentation or any decision made by a third party on the basis of this presentation. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.</p>

Then sign up below! If you have any questions, please do not hesitate to reach out to Jasper and his team.