Are you interested in our services?

Tim will be happy to answer any questions you might have.

European ABS secondary continues to trade well, COVID-19 impact on credit varies across collateral types and regions

European ABS secondary continues to trade well, COVID-19 impact on credit varies across collateral types and regionsEuropean ABS Market Update

The number of COVID-19 cases has now reached the grim milestone of 20 million, with some resurgence in parts of Europe alongside continued spread in the Americas and parts of Asia. While this was likely to occur due to easing of lockdown measures combined with the summer holiday period, the effect across countries has been varied. Parts of Eastern Europe have experienced drastic increases in case numbers , contrasting with countries in Western Europe where the resurgence remains far below March and April levels. The trend is similar in the US where cases in the Northeast, which was hit the hardest, have stabilized while the rest of the country continues to deal with a first wave of infections. This has lent some credence to the idea that the infection rate needed to reach some form of herd immunity may be significantly lower than estimated. Still, we expect soft restrictions on movement and activities to remain in place until there is a widely distributed vaccine. Despite announcements of a Russian vaccine and agreements with various pharmaceutical firms to supply vaccine doses, we remain cautious on timing of widespread vaccination with any significant distribution unlikely to occur before Q1 2021. As expected, on the macroeconomic front reports point to the euro zone economy contracting by 12.1% q-o-q in Q2 with the Spanish economy contracting by 18.5% compared to Germany, which was down 10.1% for the same period. This compares to a 20.4% decline in the UK and 9.5% in the US, highlighting a significant dispersion across Western economies in what is generally expected to be the bottom as we transition into a slow and uneven recovery in the second half of the year.

European ABS issuance remains subdued, partially due to the effects of COVID-19 compounded by the typical lull in European markets during the summer holiday period. There were two RMBS issuances, one French and one Italian (both fully retained), during the first week of August, which could point to some transactions in the pipeline in the fall. This continues the trend from the last weeks of July, where deals are retained or mostly pre-placed with only a few senior tranches being marketed. In the absence of new issue supply, European ABS secondary continued to perform well with senior peripheral RMBS tranches trading especially well during the last month. ECB eligible assets have continued to grind tighter with Dutch Prime RMBS closing the month close to the pre-COVID-19 tights. BWIC execution was robust with most bonds trading, as the level of DNTs has fallen below ~5%, notably lower than the typical 10-20% range observed in recent months.

We continue to monitor the fundamental credit performance of various ABS asset classes and highlight some trends which continue to develop. In RMBS, delinquency rates broadly remain stable with payment holidays remaining high in some jurisdictions (e.g. UK). Dutch RMBS continues to be the strongest performer with both payment holidays and arrears at low levels, but peripheral RMBS (e.g. Spanish and Portuguese) are holding up quite well albeit with somewhat higher payment holiday rates. The same performance dispersion also affects Auto ABS, where German delinquency rates continue to outperform rates in other countries.

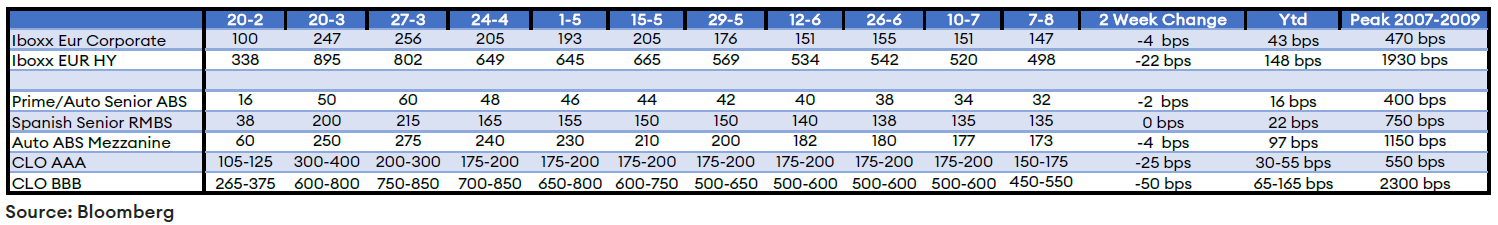

Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of August 7th, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.