Are you interested in our services?

Tim will be happy to answer any questions you might have.

Global Markets Rally on Back of Monetary and Fiscal Policy Intervention, Credit Showing Signs of Deterioration…

Global Markets Rally on Back of Monetary and Fiscal Policy Intervention, Credit Showing Signs of Deterioration…European ABS Market Update

Global markets rallied last week on the back of monetary and fiscal policy intervention and a wave of optimism that outweighed continuing negative macro developments. Announcements of selected economic re-openings as a result of flattening COVID-19 curves and news of promising treatment findings (e.g. remdesivir) drove the positive sentiment.

Negative headlines included secondary outbreaks in countries thought to have achieved containment (i.e. Singapore, Japan), unprecedented US and Norwegian unemployment numbers, and May contracts for West Texas Intermediate (WTI) oil delivery trading as low as negative(!) $37 a barrel, highlighted just how far real economic activity has fallen. On the opposite (positive) end of the spectrum, with the number of new cases declining in large parts of Europe, the conversation has turned towards exit strategies. Austria and Italy have gradually allowed small shops to open this week, some Danish students will start returning to school on Wednesday and selected non-essential Spanish factories have reopened. However, a return to somewhat normal business activities remains far from clear without a vaccine. While France has presented an ambitious plan to lift all restrictions by August, the UK extended its lockdown by “at least” 3 weeks and suggested that some restrictions could remain in place until a vaccine is found.

In terms of fundamental credit performance - although some April ABS transaction reports showed mild signs of credit deterioration in the form of higher delinquency rates, it remains too early to make broad judgements. Only after we have received quarterly reports from a wide crosssection of country and asset types can we assess the impact of both economic conditions on borrowers and judge how well social safety nets are functioning. In the CLO space the feedback loop has been significantly faster, as CCC rated loans in European CLO portfolios increased 3x-4x in March to 6%-9% (a.o. 01.04.20), while rating agencies have put over 1,000 CLO tranches on watch for rating downgrade. As credit performance unfolds, fiscal policy support dominated sentiment in the last two weeks, as the Federal Reserve announcement that it would start buying high yield bonds triggered a modest rally in both US and EUR loan and CLO markets. Even though neither European paper nor leveraged loans is eligible for Fed purchase, there was a pronounced trend of US CLO buyers crossing over to EUR market driven by perceived relative value given exposure of US CLOs to the battered energy sector.

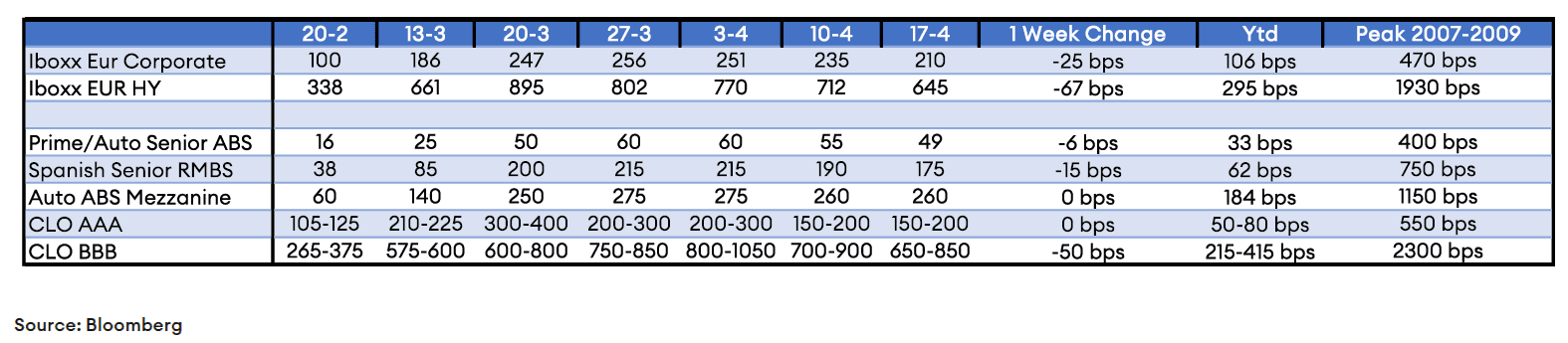

Last week we saw again most asset classes trading stable to slightly better compared to last week, though spreads have flattened off (with this week noticeably weaker) as real money account selling picked up. With the primary ABS market on hold and the primary CLO market consisting of banks trying to sell existing warehouse exposures from their balance sheet, trading activity is confined to secondary BWICs. As the relief rally lost steam in the face of buyers failing to meet selling demand, we saw DNTs increase into the 30-40% range. Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of April 10, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.