Are you interested in our services?

Tim will be happy to answer any questions you might have.

Historic rally in equities improves tone in credit markets for now…

Historic rally in equities improves tone in credit markets for now… Governments Act, Markets React, No Bottom Yet

Equity and credit markets remained extremely volatile with the US stock market experiencing a record three-day rally before slowing down into the weekend. The rally followed numerous announcements by governments and central banks around the world enacting the most aggressive fiscal and accommodative monetary policies in decades to combat the public health and economic effects of COVID-19.

While the support was well-received, the question remains if the policy measures will prove sufficient to quell potential second and third order aftershocks (with the expectation that more fiscal stimulus is likely to follow as the crisis continues). In our view, to call a bottom we need to see more signs that: i) the COVID-19 pandemic is close to peaking; and ii) that the post-pandemic global economy will remain largely intact. While there is some mixed evidence that quarantines might be working in Italy, much of the rest of the world is still seeing accelerating numbers of cases. We are likely still weeks away from seeing the potential benefits of social distancing and quarantine procedures.

While we remain over 20% below recent highs, the historic rally in equities markets last week improved the tone in the credit markets. We observed a number of investors begin building new positions. Investment grade credit stabilized and high yield rallied somewhat. Although ABS and CLO markets continued to drift wider, bid-ask spreads were noticeably tighter as more trades hit the screens.

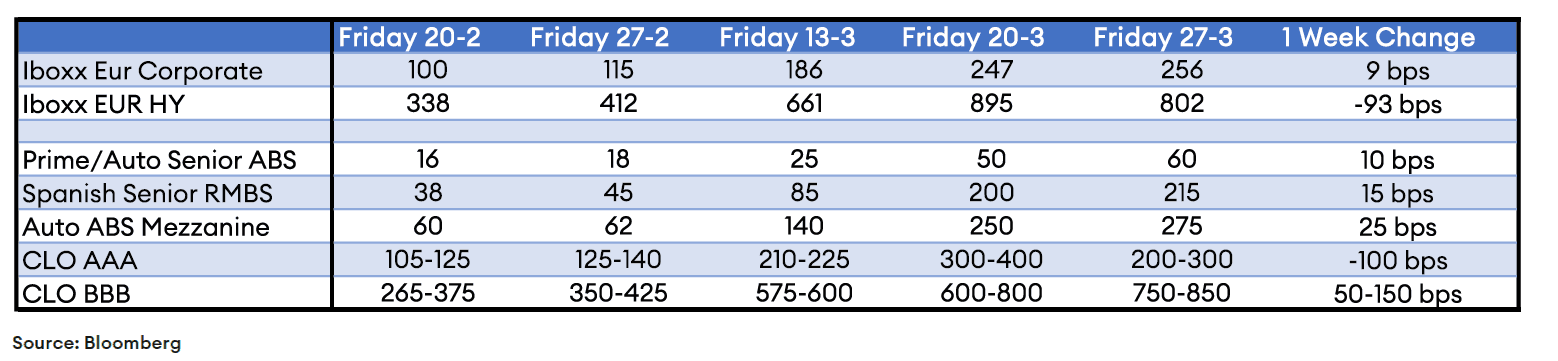

AAA CLOs (which in our opinion were the most oversold) saw the most dramatic rebound of about 100 basis points as many fast and real money accounts bought in significant size. BWIC execution remained stable with an estimated traded ratio around 50% in the face of higher trade volume, which is remarkable considering our experience during the financial crisis. ECB eligible assets continue to hold relatively steady due to technical support from the PEPP and APP and are becoming more attractive for certain investors as asset managers continue to raise liquidity. Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of March 27, 2020:

Disclaimer Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.