Marketplace Lending

Marketplace LendingBlog

Marketplace Lending

As with many other technological enhancements in the finance industry, this alternative form of lending is part of the growing trend of disintermediation of banks from financial transactions.

Marketplace Lending (MPL) refers to lending by Fintech platforms rather than traditional lenders, e.g. banks. The loans are directly funded, fully or partially, by one or more parties who invest through the platform. As with many other technological enhancements in the finance industry, this alternative form of lending is part of the growing trend of disintermediation of banks from financial transactions. MPL was previously more commonly referred to as "peer-to-peer (P2P) lending," since the market originated as retail investors were lending to borrowers, however most funding is now provided by institutional investors.

In summary, platforms use proprietary credit underwriting criteria, including the increasing use of non-traditional data sources, to assess the credit risk of a borrower as well the applicable interest rate. However, perhaps the greatest innovation by this new breed of lenders is making the loan application process faster and simpler with many lenders offering instant to same day approvals over the internet compared the more intensive and drawn out process of borrowing from a traditional bank. MPL platforms cover a range of different borrowers ranging from small businesses seeking funding to consumers looking to refinance credit card debt to students looking to pay for higher education.

<blockquote><p>MPL also has been touted as part of a solution to increase availability of access to loans to borrowers that may have had to traditionally rely on credit card or high interest rate debt that are often not eligible for or discouraged from taking out bank loans</p></blockquote>

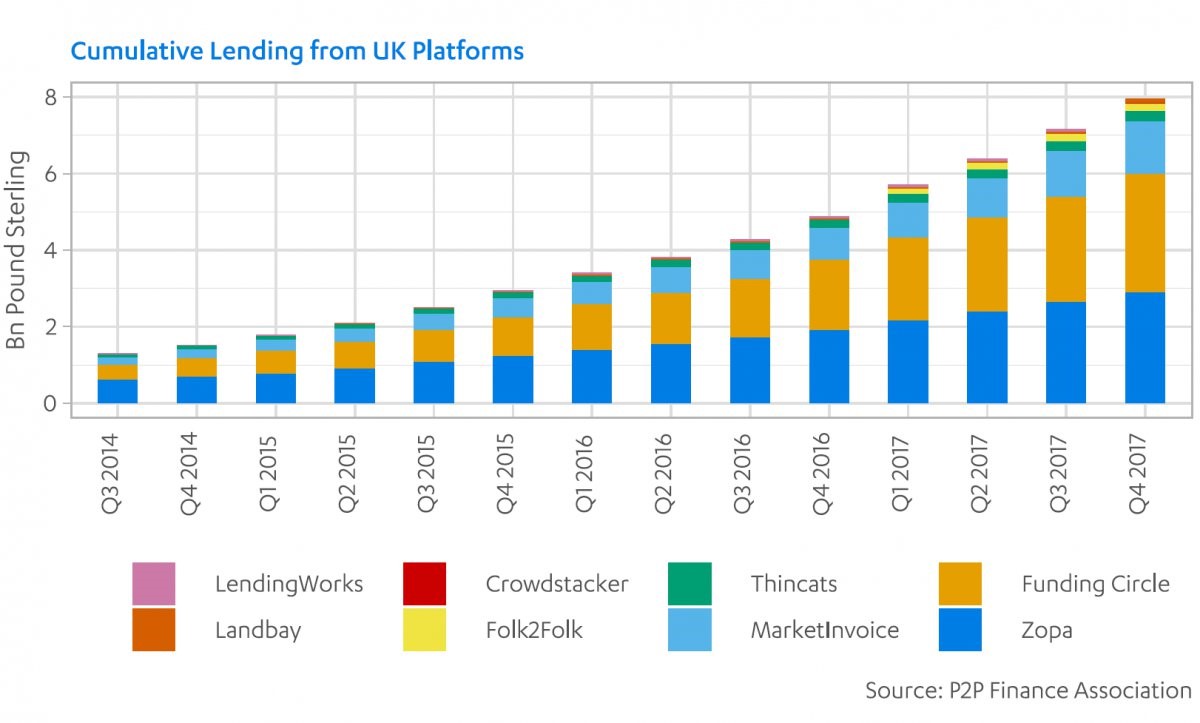

MPL also has been touted as part of a solution to increase availability of access to loans to borrowers that may have had to traditionally rely on credit card or high interest rate debt that are often not eligible for or discouraged from taking out bank loans. This is only possible since MPL directly connects investors and borrowers by-passing the usual financial intermediators. The first projects in the United Kingdom (e.g. Zopa in 2005) and the United States (e.g. Prosper and Lending Club in 2006 and 2007, respectively) received particular attention when lending fell dramatically during the financial crisis and the subsequent banking re-regulation thereafter. In 2016, outstanding MPL loans in the UK reached almost GBP 5 billion [1] while $35 billion were taken out in the United States only that year [2].

Tremendous growth

From inception to current, the largest providers of MPL have grown tremendously: LendingClub has issued $460 million in loans by the end of 2011, which increased to nearly $16 billion by 2015 and stands currently above $38 billion. In Europe, Funding Circle has originated £5 billion since 2010 and confirmed its IPO plans in September this year. MPL players have also grown all over Europe, such as consumer lenders Auxmoney in Germany, Mintos in Latvia, and Younited in France.

Aside from the benefits for borrowers, MPL also unlocks a completely new asset class for fixed income investors. Consumer loans can provide high absolute returns and diversification benefits due to a historically low correlation with government and corporate credit. For ABS investors, MPL has provided an interesting new source of collateral. While the European MPL ABS market is still in the early stages of development, with only three deals, MPL securitization activity in the United States has already become a significant asset class with total issuance of $13.2 billion across 43 deals to date. We expect MPL platforms to continue to use ABS as a funding source given their increasing origination volumes and the attractiveness of term funding vehicles as unlike banks they do not have access to cheap deposit funding.

While the future of MPL ABS still looks bright, investors should rightly keep a close eye on the evolution the various platforms as MPL is still a relatively young asset class that remains to be really tested. We expect there to be consolidation in the market as platforms that don’t maintain underwriting discipline and don’t grow their business prudently will eventually fail. As with any other asset class, we are optimistic, but cautious and careful with our investor’s capital as we diligently search for attractive risk profiles in the current environment.

Authors

Mike Li

Senior Portfolio Manager

+1 212 710 6608

Mike Li is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities and Direct Lending and heads the New York office. Mike joined Dynamic Credit in 2007 and was part of the team that set up the Amsterdam office in 2009, before moving back to New York in 2012. He has been investing in a broad spectrum of cash and derivative credit products in the US and Europe for over 10 years. Mike began his career at Deutsche Bank in the Graduate Programme, rotating through several business lines, including Agency MBS Trading and CDO Trading/Warehousing. Mike holds a M.S. in International Finance from the University of Amsterdam and a B.S. in Finance and Accounting from New York University.

Tim Jansen

Senior Portfolio Manager

+31 20 705 95 94

Tim Jansen is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities. Tim joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in his role as Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a M.S. in Econometrics from Erasmus University Rotterdam.

Pascal Buehrig

Junior Analyst

Pascal Buehrig is a former Junior Analyst at Dynamic Credit.

Sources

[1] P2P Finance Association [2] Morgan Stanley Investment Management, July 2018: “An Introduction to Alternative Lending”

Disclaimer

The information contained in this document (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Dynamic Credit and its associated companies to be reliable but are not guaranteed as to its accuracy or completeness. Such information is provided without obligation and on the understanding that any person who acts upon it or changes his investment position in reliance on it does so entirely at his own risk. The information contained herein is suited for professional investors only and does not constitute an offer to buy or sell or an invitation to make an offer to buy or sell shares in any investment referred to herein. Information in this document is current only as at the date it is first published and may no longer be true or complete when viewed by you. All information contained herein may be changed or amended without prior notice although neither Dynamic Credit and nor any of its associated companies undertakes to update this site regularly.

NOTHING CONTAINED IN THIS DOCUMENT CONSTITUTES INVESTMENT, LEGAL, TAX, OR OTHER ADVICE OR RECOMMENDATION, NOR IS TO BE RELIED ON IN MAKING AN INVESTMENT OR OTHER DECISION. YOU SHOULD OBTAIN RELEVANT AND SPECIFIC PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT DECISION.