In the Search for Yield, Don’t Miss the Forest for the Trees

In the Search for Yield, Don’t Miss the Forest for the TreesBlog

In the Search for Yield, Don’t Miss the Forest for the Trees

CLOs have recently become very popular among investors, as they offer a rare combination of high returns, protection from rising interest rates and strong fundamental credit performance through the financial crisis.

To summarize from a previous newsletter*, CLOs are backed by portfolios of non-investment grade senior loans, often leveraged loans from Private Equity sponsored mergers and acquisitions (M&A) or leveraged buy-outs (LBOs). CLO debt tranches with different ratings and loss exposures backed by these loans are then sold to investors via capital markets.

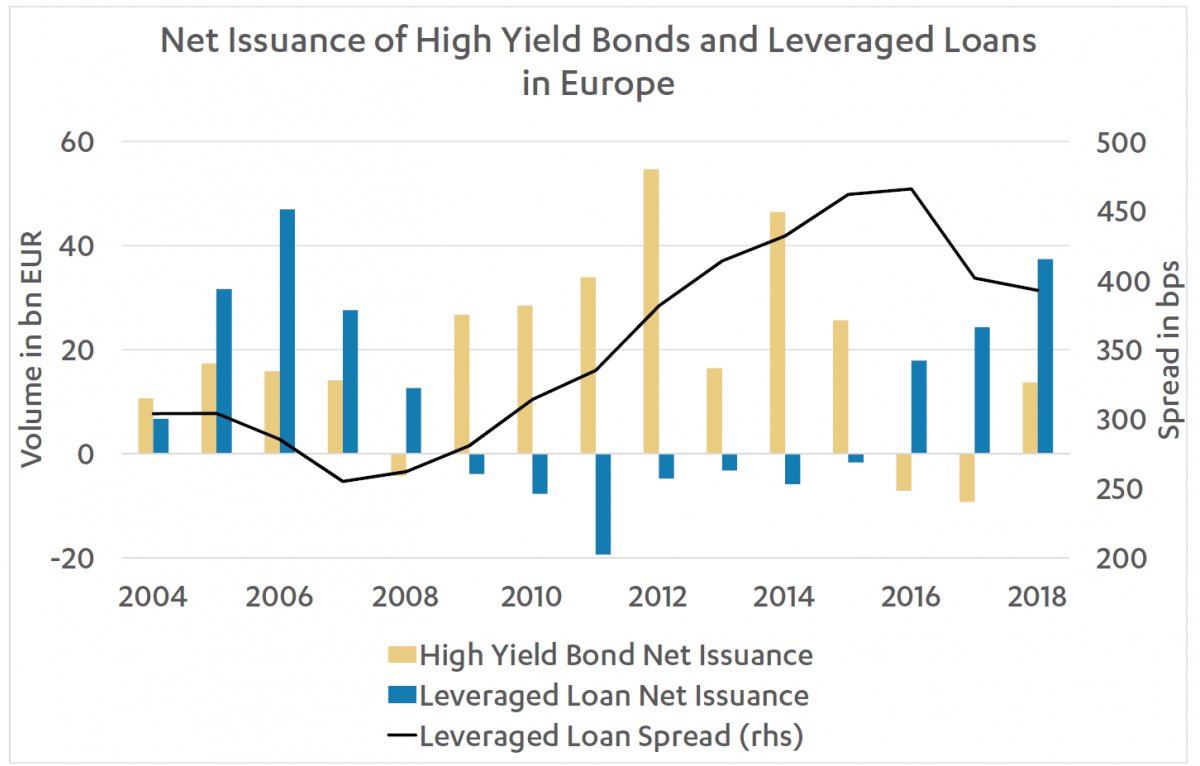

| One natural result of the increase in demand for CLO debt is the higher availability of funding to companies, backed by Private Equity or otherwise, which have generally taken out increasing amounts of inexpensive debt. In fact, 2018 was the best year of issuance for CLOs post-crisis in Europe and the highest ever in the US. However, the other side of increasing volume is the decline in loan quality, as companies have an ever-growing debt load in the face of a rising rate environment. So far, the effects have been relatively minor because many borrowers have taken the opportunity to delay the maturities of their debt. Nevertheless, investors should be cautious as those borrowers will eventually have to refinance at higher rates in the future. Chart 1 shows how the issuance of leveraged loans as well as their spreads have developed in Europe. |  Source: Morgan Stanley, December 2018 Source: Morgan Stanley, December 2018 |

<blockquote><p>A clear signal of the decline in loan quality comes from the trend in company net leverage.</p><span class="writer">Mike Li</span></blockquote>

A clear signal

A clear signal of the decline in loan quality comes from the trend in company net leverage, which is the multiple of the company’s debt over earnings. For example, net leverage of European high-yield companies reached 4.2x of EBITDA, which is the highest reading since 2010 [1]. In fact, the average multiple for European borrowers of leveraged loans issued in 2018 is 5.3x, a new record since the pre-crisis levels around 5.9x [2]. The same trend can be seen in the Investment Grade bond market, where the lowest rating tier (BBB) made up 19% of the issuance in 2009 and has increased to 59% by 2018 [3].

Another important signal is the share of loans with loose or no maintenance covenants in CLO portfolios, otherwise known as "cov-lite". This refers to loans that do not have provisions such as maximum leverage, minimum interest coverage, or other rules to regulate the company’s debt. Another important aspect of cov-lite loans is loose language on the calculation of key financial numbers (e.g. EBITDA). Per Fitch, the share of cov-lite among European leveraged loans originated every year has increased tremendously from 20% in 2013 to over 75% by 2017 [4].

An especially worrisome development in weakening covenants is the so-called "collateral stripping". An example of this was the U.S. retailer J. Crew in 2016, which is partially financed with senior secured loans. The company used the weak clauses to transfer intellectual property, which served as the security for those senior loans, to one of its subsidiaries. This allowed J. Crew to raise money through new secured corporate bonds whereas the original loan lenders became essentially unsecured and subordinated. Moreover, J. Crew intended to use these additional funds to redeem other unsecured bondholders, which made the situation especially noteworthy.

Source: Morgan Stanley, December 2018

Source: Morgan Stanley, December 2018

The reason for this overall deterioration in credit quality is likely a combination of loose monetary policy and a general investor scramble for yields. However, three of the most important central banks are about to, or have already started to, tighten monetary policy. The U.S. Federal Reserve stopped quantitative easing in December 2015 and has raised interest rates seven times since. The same path was taken by the Bank of England at the end of 2017. In continental Europe, the reference rate is still set at zero. However, ECB president Draghi has announced the end of the asset purchase program as of 2019. Thus, higher costs of debt are expected across the board, absent major shifts in monetary policy.

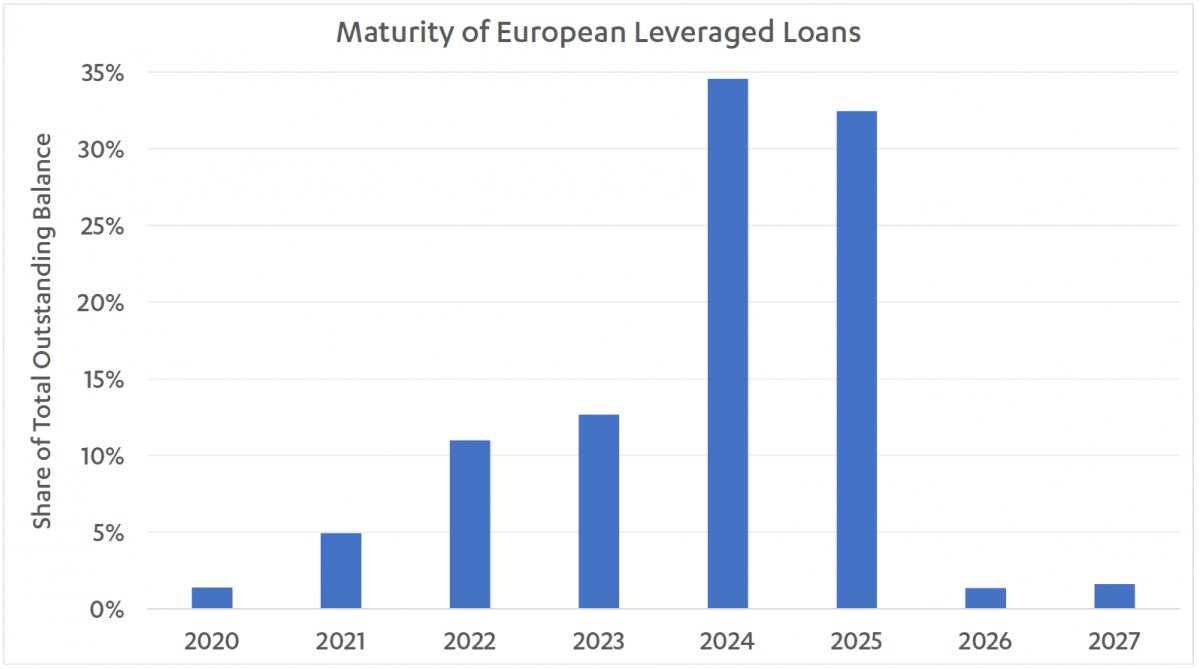

The problem of high leverage combined with higher interest costs in the future creates a dangerous situation in an environment where earnings growth is also slowing. The problem will be exacerbated when large chunks of debt come due and many borrowers seek to refinance their loans at the same time. Even if investors have positioned themselves well against credit risk, mark to market risk also is a source of concern. Specifically, for European leveraged loans, chart 2 highlights that the issue will become acute in a few years. While less than EUR 30bn is set to mature by the end of this year, EUR 170bn is expected to mature in four years from now [5].

<blockquote><p>The share of cov-lite among european leveraged loans originated every year has increased tremendously from 20% in 2013 to over 75% by 2017.</p><span class="writer">Tim Jansen</span></blockquote>

On balance, while the CLO product still should be an integral part of a fixed income portfolio, we believe that investors should be selective in their exposures. For example, the Dynamic Credit Defensive Strategy Fund maintains a significant allocation to CLOs but has been shifting exposure both to shorter duration as well as to the most senior tranches.

Authors

Mike Li

Senior Portfolio Manager

+1 212 710 6608

Mike Li is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities and Direct Lending and heads the New York office. Mike joined Dynamic Credit in 2007 and was part of the team that set up the Amsterdam office in 2009, before moving back to New York in 2012. He has been investing in a broad spectrum of cash and derivative credit products in the US and Europe for over 10 years. Mike began his career at Deutsche Bank in the Graduate Programme, rotating through several business lines, including Agency MBS Trading and CDO Trading/Warehousing. Mike holds a M.S. in International Finance from the University of Amsterdam and a B.S. in Finance and Accounting from New York University.

Pascal Buehrig

Junior Analyst

Pascal Buehrig is a former Junior Analyst at Dynamic Credit in 2018.

Sources

[1] J.P. Morgan, Europe Credit Research (11/24/2018)

[2] Morgan Stanley, 2019 European ABS Outlook (11/29/2018)

[3] J.P. Morgan, Europe Credit Research (11/12/2018)

[4] Fitch Ratings, European Leveraged Loan Chart Book (Q2:2017)

[5] AFME / Finance for Europe, European High Yield & Leveraged Loan Report (Q1:2018)

- Dynamic Credit Newsletter Q4 2017

Disclaimer

The information contained in this document (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Dynamic Credit and its associated companies to be reliable but are not guaranteed as to its accuracy or completeness. Such information is provided without obligation and on the understanding that any person who acts upon it or changes his investment position in reliance on it does so entirely at his own risk. The information contained herein is suited for professional investors only and does not constitute an offer to buy or sell or an invitation to make an offer to buy or sell shares in any investment referred to herein. Information in this document is current only as at the date it is first published and may no longer be true or complete when viewed by you. All information contained herein may be changed or amended without prior notice although neither Dynamic Credit and nor any of its associated companies undertakes to update this site regularly.

NOTHING CONTAINED IN THIS DOCUMENT CONSTITUTES INVESTMENT, LEGAL, TAX, OR OTHER ADVICE OR RECOMMENDATION, NOR IS TO BE RELIED ON IN MAKING AN INVESTMENT OR OTHER DECISION. YOU SHOULD OBTAIN RELEVANT AND SPECIFIC PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT DECISION.