Are you interested in our services?

Tim will be happy to answer any questions you might have.

Slow Trading Week for Euro ABS, First Impact of COVID Crisis on Fundamental Credit Performance Observed

Slow Trading Week for Euro ABS, First Impact of COVID Crisis on Fundamental Credit Performance ObservedEuropean ABS Market Update

Global equity markets lost momentum last week, as outlook warnings resurfaced US-China tensions, and continued deterioration in economic data outweighed optimism over lifting social distancing measures in many countries. Q1 GDP numbers showed a contraction of 3.5% in Europe and 4.8% in the US, with Q2 expected to be far worse. While consensus is that there will be an initial bounce in Q3, in the absence of a vaccine or herd immunity, we don’t expect to see pre-pandemic levels of economic activity for years. There was no new major news on the fiscal or monetary policy fronts, but we expect both to remain in the wings pending the progress (and likely setbacks) in the reopening process.

In terms of fundamental credit performance, we have started to see the first real effect of the pandemic crisis on consumers. Looking at the first 21 UK RMBS deals that report monthly for which data is available (GBP 15.5 billion of mortgages), the proportion of loans that have been granted COVID-19 payment holidays is as high as 14.1%, with ten transactions seeing a 10%+ proportion of payment holidays. In several CMBS deals, senior borrowers have received numerous requests from tenants for rent deferrals or for renegotiation of tenancy agreements. In these deals, approximately 75% of rent due in April was collected. In leveraged loans, S&P adjusted their recovery rate expectations from 73% to below 60%, which will compound losses from expected rising loan defaults.

In a slow week with thin trading volumes, spreads in the European ABS secondary market remained generally consistent to slightly tighter week- over-week. The market appears to be in a holding pattern awaiting a direction based on fundamentals. Senior and low duration bonds continue to trade well, while buyers and sellers remain far apart on more credit sensitive bonds. The ABS primary market remains on hold, providing technical support to spreads. In the CLO primary market, three low leverage deals with short non-call and reinvestment periods were placed. In the secondary market, CLO BWIC supply was noticeably lower than average with an elevated DNT percentage.

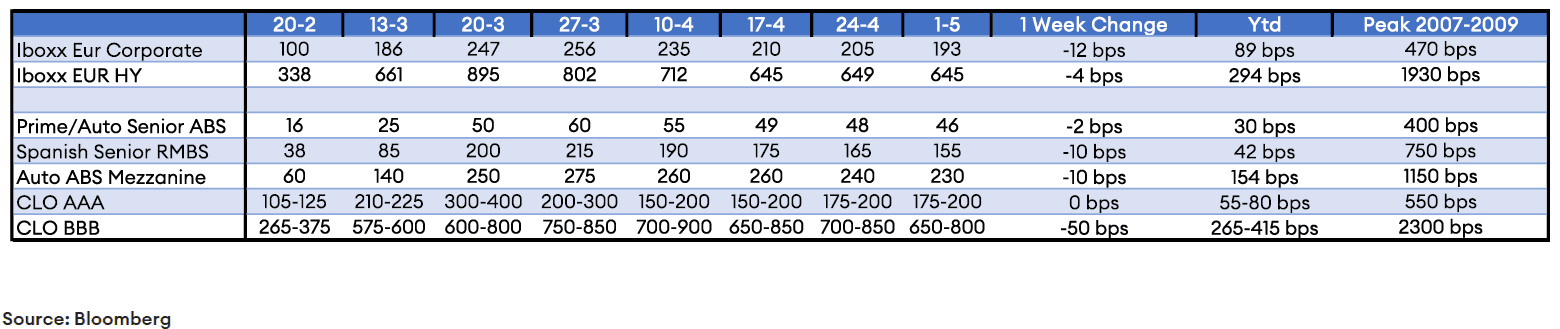

Below is an overview of the one week spread change in various ABS segments, compared to investment grade and high yield corporate credit as of May 1, 2020:

Dynamic Credit Partners Europe B.V. (‘Dynamic Credit’) is a registered investment company (beleggingsonderneming) and a registered financial service provider (financieel dienstverlener) with the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten). This document is intended for informational purposes only and is subject to change without any notice. The information provided is purely of an indicative nature and is not intended as an offer, investment advice, solicitation or recommendation for the purchase or sale of any security, financial instrument or financial product. This communication is a summary only, it may not contain all material terms. Any offering that may be related to the subject matter of this communication will be made to you pursuant to separate and distinct documentation (Legal Documentation) and in such case the information contained herein will be superseded in its entirety by any such Legal Documentation in its final form. Dynamic Credit may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Dynamic Credit cannot be held liable for the content of this document or any decision made by a third party on the basis of this document. Potential investors are advised to consult their independent investment and tax adviser before making an investment decision. An investment involves risks. The value of securities may fluctuate. Past returns are no guarantee for future returns.

Tim will be happy to answer any questions you might have.

Tim Jansen is a member of the Portfolio Management team for the Diversified Loan Fund. He joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in the role of Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a master's degree in Econometrics from Erasmus University Rotterdam.