The periphery is back

The periphery is backBlog

The periphery is back!

In a tightly priced fixed income and ABS universe, Spain and Ireland offer relatively interesting risk return profiles.

After too much pre-crisis housing construction and oversupply, particularly in Spain, conversely low construction activity and constrained housing supply post-crisis have led to a strong recovery in recent years, which has been particularly beneficial for investors holding RMBS backed by housing from both countries.

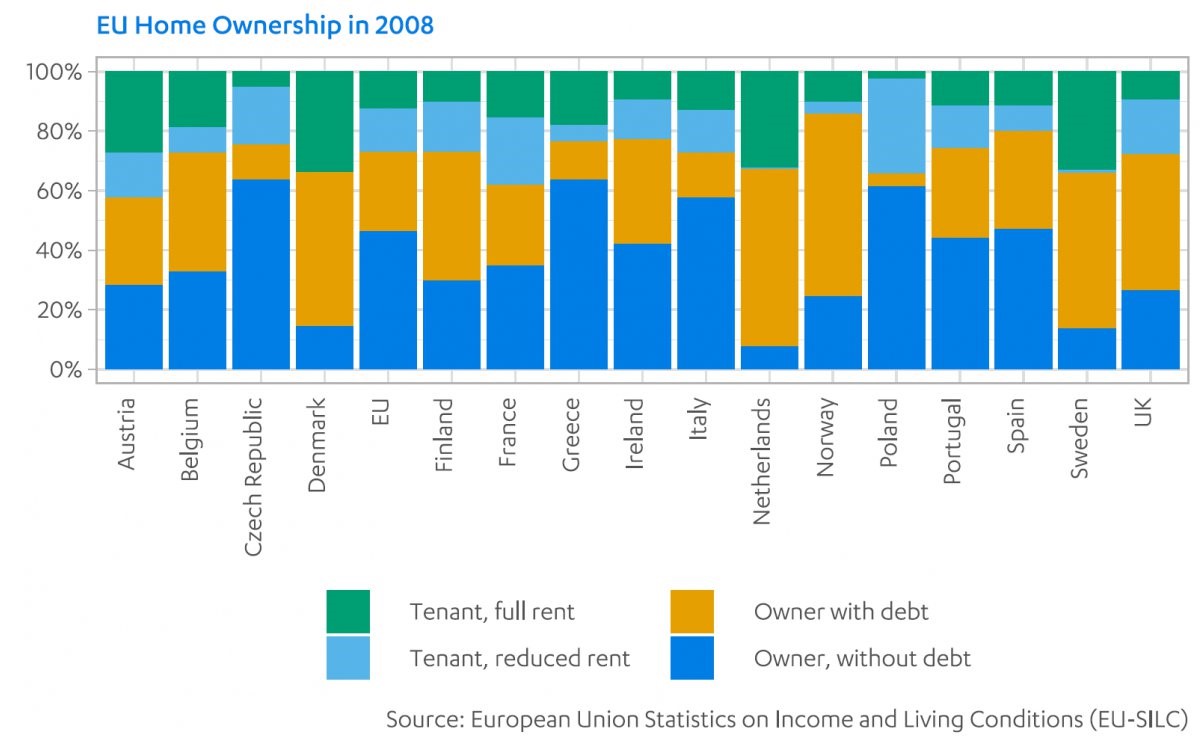

Spain and Ireland share a common history of housing market rallies and dramatic bubble bursts. The driving factors behind those market dynamics have been strikingly similar: both Ireland and Spain have comparatively high rates of home ownership in the population (both above 80% versus 72% in the EU on average). A central reason for this was, and partially still is, the relative attractiveness of home ownership due to generous tax incentives for mortgage borrowers. As a result, due to relative ease of getting financing, construction investments reached stunning weights, relative to GDP, of 15% in Ireland and almost 20% in Spain [1] at the top of the market. When unemployment rates peaked at 16% in Ireland and 24% in Spain [2] during the European debt crisis, mortgage loans saw a correspondingly high rate of default, leading to a sharp decrease in house values. Moreover, given the large percentage Irish and Spanish banks balance sheets dedicated to housing (both mortgages and loans to construction-related businesses), the housing market downturn also disproportionately affected over-indebted local banks.

<blockquote><p>Spain and ireland share a common history of housing market rallies and dramatic bubble bursts</p></blockquote>

Housing Market Recovery in Spain

The Spanish housing market has continued to recover after reaching the trough in 2014. Per the Ministry of Development, Spanish house prices have appreciated by more than 7% since then. Mortgage approvals hovered near 30.000 in April 2018, compared to 130.000 at the latest peak in 2006 [3]. The Spanish economy has also stepped out of recession and has grown annually by 3% or more over the last three years, with a slight slow-down this year. At the same time, unemployment has fallen from the peak of almost 27% down to around 15% currently. The OECD expects Spain to keep growing on a robust, but more moderate level which should continue to support domestic demand for housing in the near term.

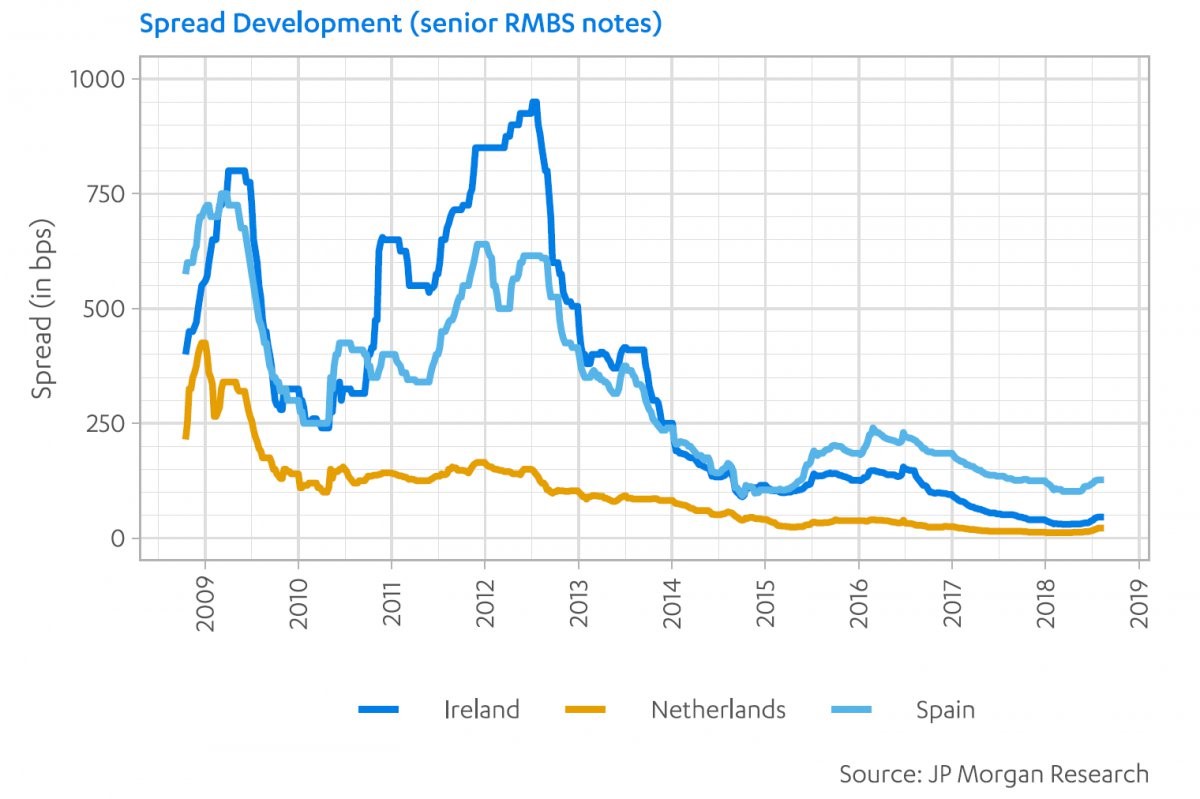

The improved performance of Spanish RMBS has been supported by rating agency upgrades of government bonds, and thus of the rating ceilings for any Spanish ABS in April 2018. As a result, the weighted-average rating for Spanish RMBS by Standard & Poor’s has increased from A(sf) to A+(sf). Although valuations at the senior level have become tight largely due to the ECB asset purchase program (ECB-eligible senior notes trade around 50 bps as of mid-September), mezzanine notes offer both higher yields and higher credit enhancement compared to other segments of European ABS. For example, Spanish A-rated RMBS offer 202 bps spread compared to 115 bps for Dutch equivalents [4].

<blockquote><p>Compared to spain, the recovery in ireland has been even more impressive as a willingness to make the necessary structural reforms and to take the necessary write downs on bad loans have paved the path to recovery./p></blockquote>

While the road to recovery continues to be bumpy, as highlighted by the Spanish Tenancy Act providing the citizen’s general right to have accommodation (which is borrower friendly) and recent political disruptions in Spain, there has not been a lasting impact on the ABS market. Especially, after the formal declaration of independence by Catalonia on 27 October 2017, observers rightly questioned whether the Spanish trajectory would change. For now, the ousting of former Spanish Prime Minister Rajoy on 1 June 2018, has renewed confidence in a more pragmatic approach of the central government towards the Catalans and the housing recovery continues to hum along.

Ireland back on track to Core-European Levels

Compared to Spain, the recovery in Ireland has been even more impressive as a willingness to make the necessary structural reforms and to take the necessary write downs on bad loans have paved the path to recovery. While residential property prices were in free fall between 2007 and 2013, down an unprecedented -53.8%, the recovery has been almost equally impressive with trough-to-current recovery of around 75%. This development has been accompanied by GDP growth rates unseen in recent European history, reaching levels between +20% and +30% quarter-on-quarter during 2015 and +10% at the latest release. Moreover, unemployment has declined from the crisis climax to 5% as of mid-2018 [5].

On the back of this recovery, Irish RMBS re-entered the new issuance pipeline in 2013 and by 2017, a post crisis record number of new issuance was set at 1.7 billion. As of mid-September, senior Irish senior 5-year RMBS-notes traded around 48 bps, on par or even tighter than UK Prime RMBS at 62 bps (in GBP) [6]), according to JP Morgan Research.

However, there remain concerns, such as interventions by Irish authorities in the housing market. Much recent price appreciation can be attributed to the persistent lack of new housing supply. For example, during the second half of 2017, the Dublin municipality spent 23.9 million euros for the emergency accommodation of around 750 families in private commercial hotels! In order to address the lack of supply, the ruling Fine Gael party launched the "Rebuilding Ireland" plan already in 2016, targeting annual housing construction of 25,000 from 2020 and providing the government-backed "Home Loan" mortgages. However, annual construction currently stands at mere 50% of the envisaged target while the number of families living in emergency homeless accommodation is at the highest level recorded. As a result, the government could take additional measures to increase supply drastically, however we see this as stabilizing supply demand dynamics, rather than a return to oversupply conditions.

Additionally, we are currently watching developments in regulatory reforms regarding mortgage delinquencies. In the aftermath of the crisis, the Irish authorities instituted measures with conflicting intentions: on one side, reducing the time before repossession (which is investor friendly), and on the other, increasing obligations to a comprehensive set of actions before the repossession (which is borrower friendly). However, on the whole, there is now a general aversion against evictions and a new Mortgage Bill that is currently under discussion would bring higher regulatory scrutiny that could push legislation further in favor of borrowers, including borrowing-rate caps per lender and an end to interest-rate discrimination between new and existing borrowers.

Putting things together

We consider Spain and Ireland as investment opportunities within European alternative fixed income that are strongly backed by fundamentals. Furthermore, the respective housing markets have been especially resilient against the backdrop of economic and political noise. According to the EU Structured Finance & Covered Bond Survey by DBRS, Ireland and Spain are expected to be two of the main contributors to European RMBS issuance over the next year.

Nevertheless, we remain ever vigilant that the bonds we buy in the Fund both offer relative value and capital preservation in our stress cases.

Authors

Mike Li

Senior Portfolio Manager

+1 212 710 6608

Mike Li is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities and Direct Lending and heads the New York office. Mike joined Dynamic Credit in 2007 and was part of the team that set up the Amsterdam office in 2009, before moving back to New York in 2012. He has been investing in a broad spectrum of cash and derivative credit products in the US and Europe for over 10 years. Mike began his career at Deutsche Bank in the Graduate Programme, rotating through several business lines, including Agency MBS Trading and CDO Trading/Warehousing. Mike holds a M.S. in International Finance from the University of Amsterdam and a B.S. in Finance and Accounting from New York University.

Tim Jansen

Senior Portfolio Manager

+31 20 705 95 94

Tim Jansen is a Senior Portfolio Manager at Dynamic Credit currently in charge of investment mandates covering Asset Backed Securities. Tim joined Dynamic Credit in 2017. He has been investing in a broad spectrum of cash and synthetic credit products in Europe for over 10 years in his role as Portfolio Manager at several leading asset managers, among which NNIP, MN and Robeco. Tim began his career at Aegon Asset Management and holds a M.S. in Econometrics from Erasmus University Rotterdam.

Pascal Buehrig

Junior Analyst

Pascal Buehrig is a Junior Analyst that has been supporting the Asset Management and Advisory desks since he started his career at Dynamic Credit in 2018. Before that, Pascal gained experience in wealth and asset management at major European banks, including UBS, Credit Suisse and Deutsche Bank. Pascal holds a Master's degree in Finance (Specialization Investment Management) from Stockholm School of Economics and a Bachelor's degree in Economics and Business Administration from University of Zurich.

Sources

[1] ec.europa.eu/economy_finance/ameco/user/serie/SelectSerie.cfm [2] Trading economics, www.tradingeconomics.com [3] ibid. [4] JPM International ABS & CB Weekly, Europe Credit Research, 14th September 2018 [5] Trading economics, www.tradingeconomics.com [6] JPM International ABS & CB Weekly, Europe Credit Research, 14th September 2018

Disclaimer

The information contained in this document (including any expression of opinion or forecast) has been obtained from, or is based on, sources believed by Dynamic Credit and its associated companies to be reliable but are not guaranteed as to its accuracy or completeness. Such information is provided without obligation and on the understanding that any person who acts upon it or changes his investment position in reliance on it does so entirely at his own risk. The information contained herein is suited for professional investors only and does not constitute an offer to buy or sell or an invitation to make an offer to buy or sell shares in any investment referred to herein. Information in this document is current only as at the date it is first published and may no longer be true or complete when viewed by you. All information contained herein may be changed or amended without prior notice although neither Dynamic Credit and nor any of its associated companies undertakes to update this site regularly.

NOTHING CONTAINED IN THIS DOCUMENT CONSTITUTES INVESTMENT, LEGAL, TAX, OR OTHER ADVICE OR RECOMMENDATION, NOR IS TO BE RELIED ON IN MAKING AN INVESTMENT OR OTHER DECISION. YOU SHOULD OBTAIN RELEVANT AND SPECIFIC PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT DECISION.